How To Open a Demat Account in Zerodha? – Step-By-Step Guide

Hello reader, my name is Bablu Yadav, and I’m an intraday stock market trader and investor.

I started my investment journey through mutual funds but jumped into the stock market trading as I gained some knowledge after several years.

It’s a harsh truth that our academies don’t teach us much about money. That’s why the general population has a significant financial literacy and awareness gap, which is evident from the low percentage of Indians investing in the stock market.

As per a recent study published in Livemint, only 3% of Indians are actively investing in the stock market. In contrast, over 55% of Americans invest in the stock market.

If you’ve decided to invest in the stock market, you’re above 97% of the population. I will try to make your share market journey easy. I’ll help you with the Demat account opening process in this guide.

What is a Demat Account?

If I go with the standard definition, “A Demat account, short for “Dematerialized account,” is an electronic account used to hold and store securities such as stocks, bonds, mutual funds, and other financial instruments in a digital format.”

But, it wasn’t easy to understand when I was a beginner. You’re also confused by complex terms like securities, dematerialized, financial instruments, etc.

Let me explain in easy language…

Earlier, companies used to provide share certificates when the stock market wasn’t that popular. Later, everything was computerized, so physical share certificates were also dematerialized.

A Demat account is basically a digital account that stores your shares. It’s just like a bank account. Just like you deposit cash into your bank account, you can buy and store shares of any company in your Demat account.

How To Open a Demat Account In Zerodha?

Zerodha is the best discount broker that allows a fully digital account opening process. If your phone number is linked with an Aadhar card, you can open an online Demat account in Zerodha.

In this guide, we’ll look at the step-by-step account opening process. But you need the following documents ready before you start.

Documents Required For Zerodha Demat Account

- Aadhar Card (must be linked with your phone number).

- PAN Card

- A piece of white paper and a pen.

- A savings bank account.

- Income proof such as last six months’ bank statement or latest ITR computation for future and options (optional).

Steps to open a Demat account on Zerodha-

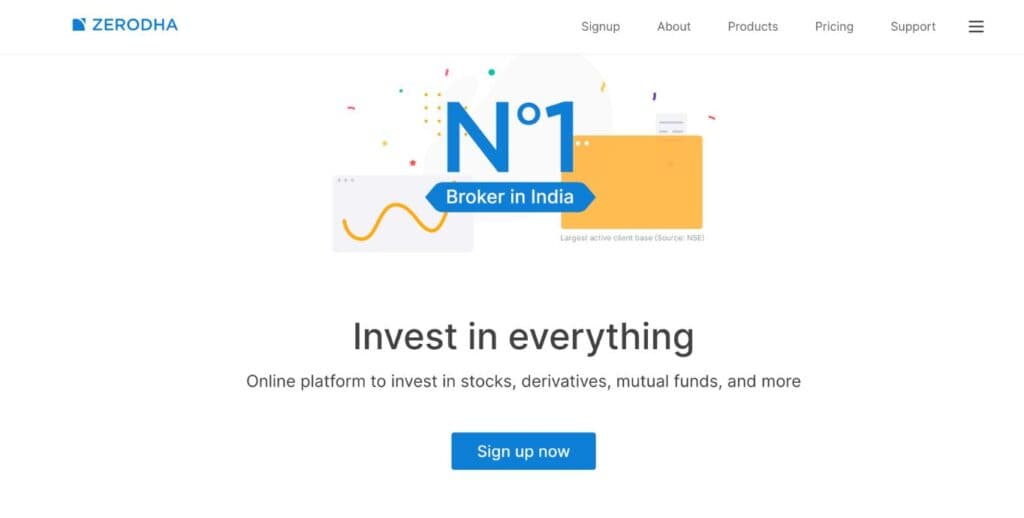

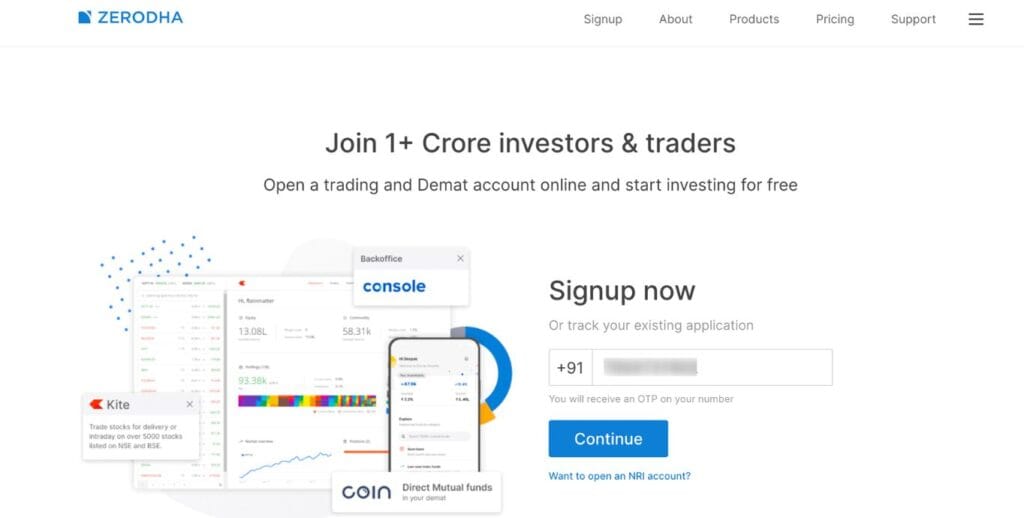

1. Go to https://zerodha.com/

First, click the link above to Zerodha’s account opening page.

2. Click on Sign up now

Once you land on the account opening page, you’ll see an option to Sign up for an account. Click on Sign up now!

3. Enter your mobile number

Enter your mobile number to sign up for a Demat account on Zerodha.

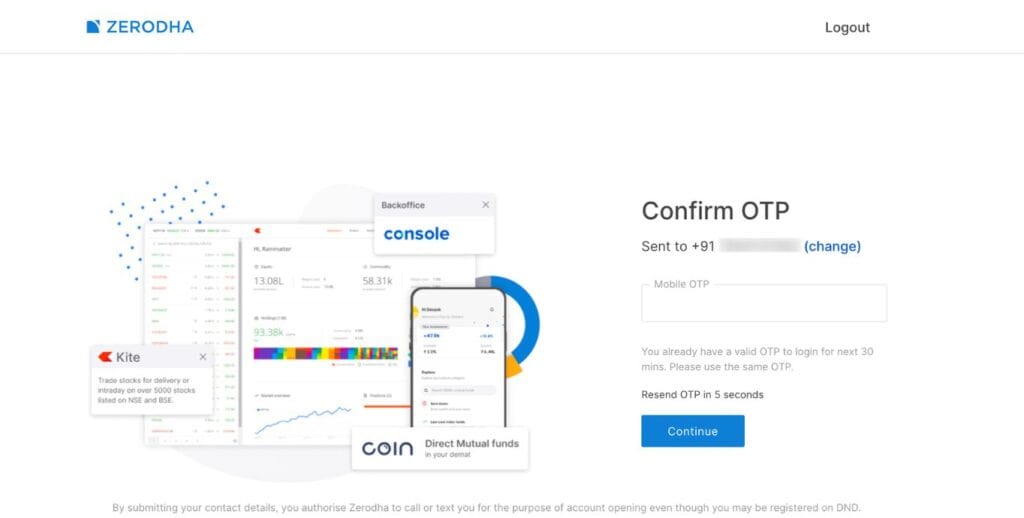

4. Enter the OTP received on your mobile number

You’ll receive an OTP on your mobile number, and please enter that. correctly.

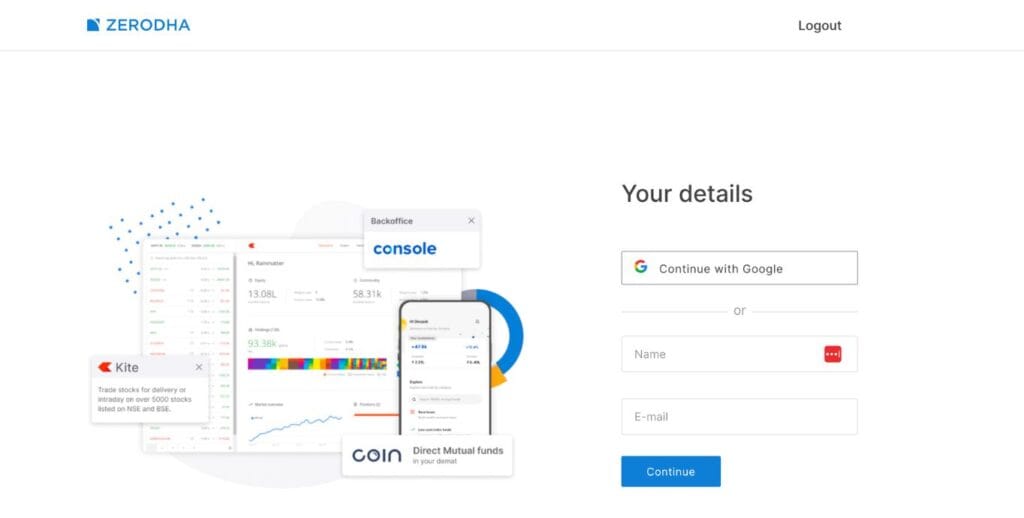

5. Enter your email address

You need to enter your full name and email address on the next page. Please enter the email address where you’ll receive login credentials and future communication.

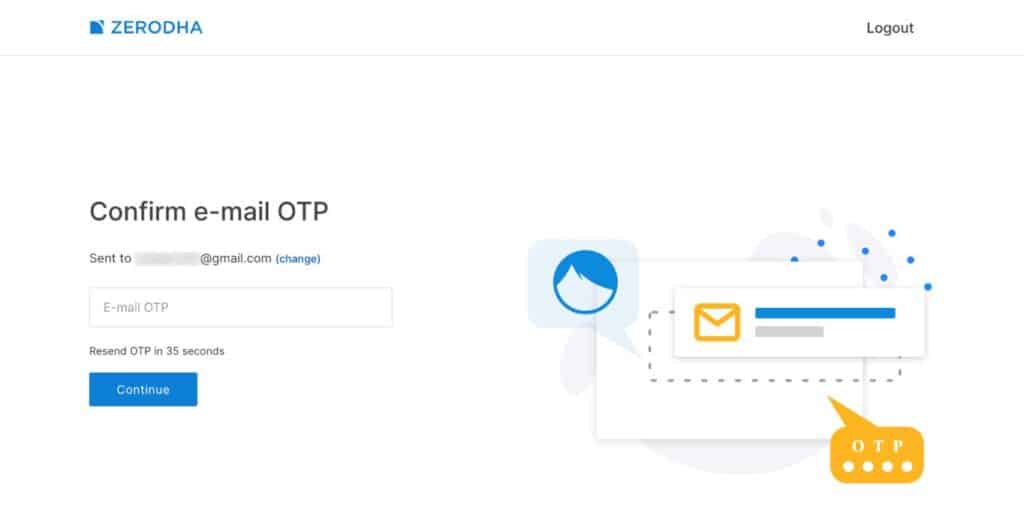

6. Verify email OTP

Zerodha will send you an OTP to verify your email address. So, check your inbox and enter the OTP.

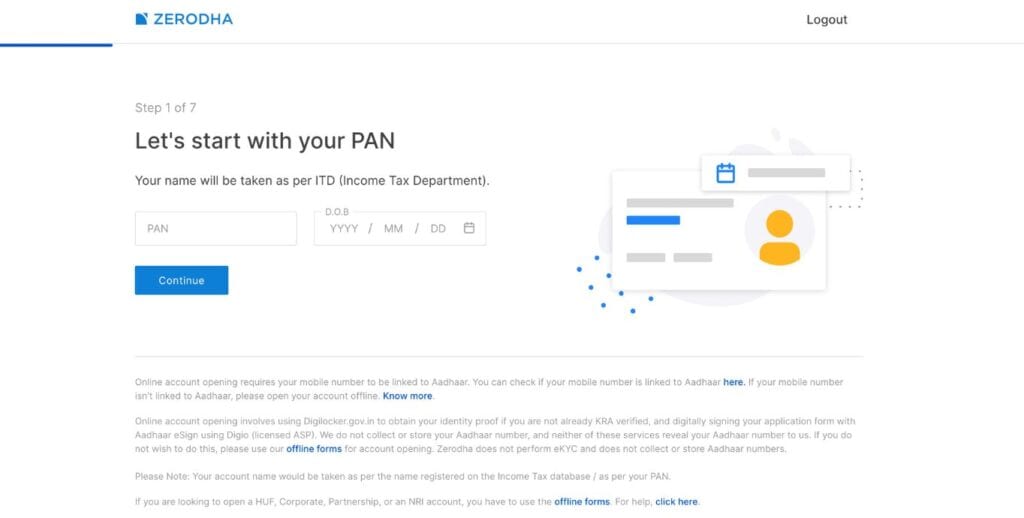

7. Enter your PAN and Date of Birth

Enter your PAN number and Date of Birth on the next page.

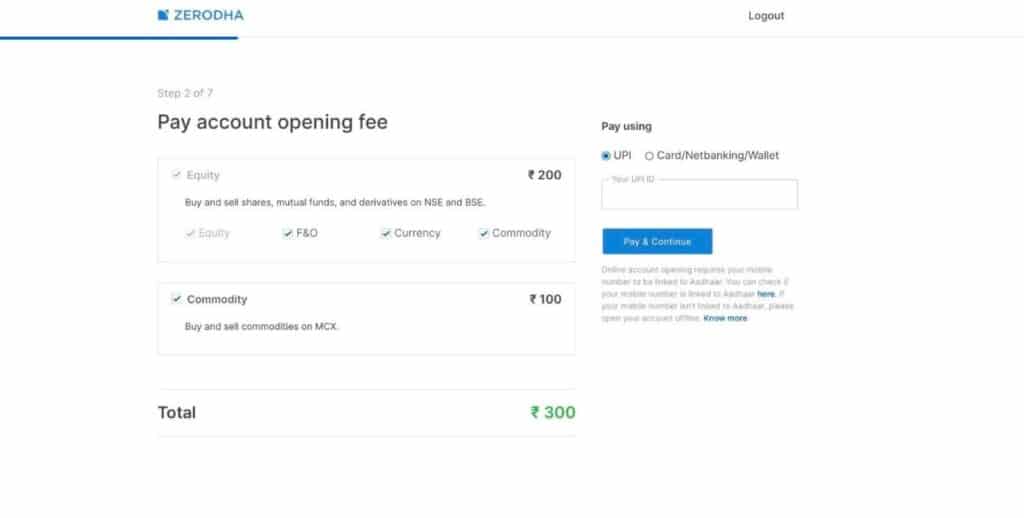

8. Pay Account opening fees

Now, you must pay a one-time account opening fee of ₹200 for equity and ₹100 for commodity accounts. You can pay this amount through UPI, Credit/Debit Card, or Internet Banking.

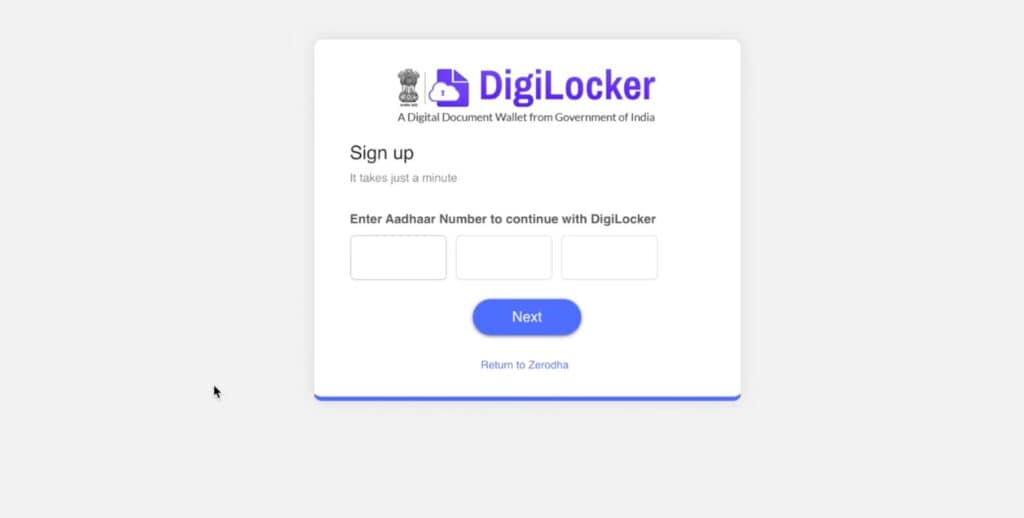

9. Verify Aadhar details with DigiLocker

After completing the payment, you need to verify your Aadhar details with DigiLocker. If you don’t have an account with DigiLocker, first sign up. Click on https://www.digilocker.gov.in/ to go to the DigiLocker account sign-up page.

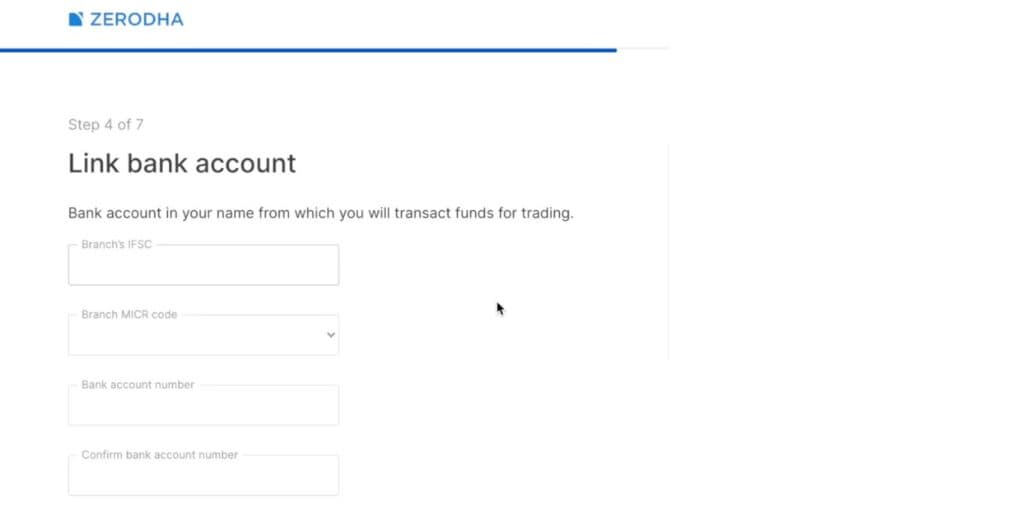

10. Enter your Bank account details

Enter the bank account details that you want to link with Zerodha. You can add or withdraw funds through this account only.

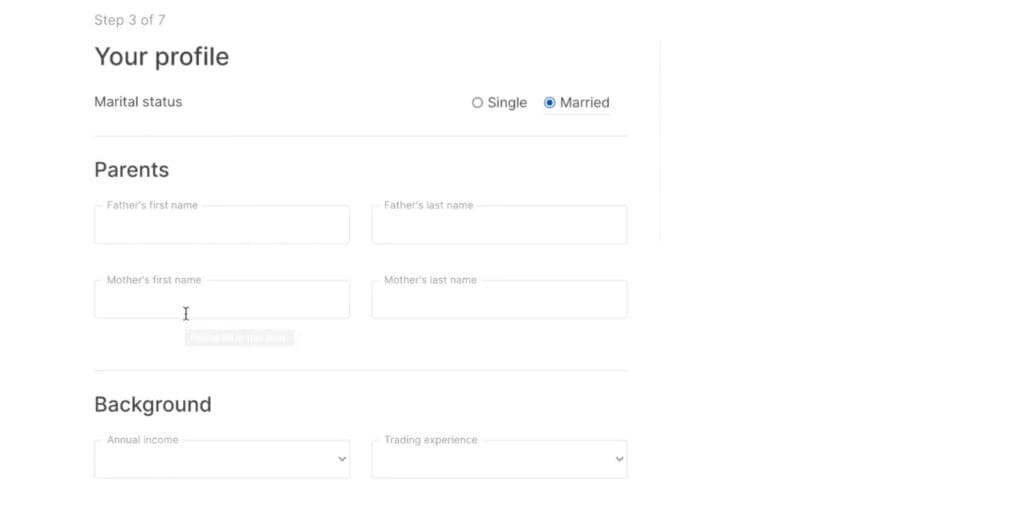

11. Enter your Profile and Background

Complete your profile by entering all details asked on the next page. Enter your marital status, father’s name, mother’s name, annual income, trading experience, etc.

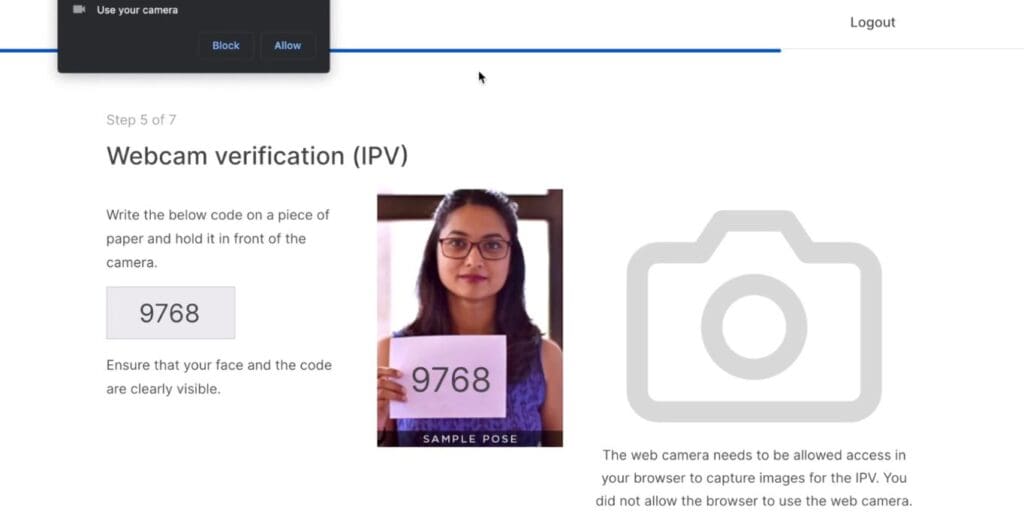

12. Complete Webcam verification

You have to complete a Webcam verification. So, give your browser camera access permission. Take a white paper, write down the number visible on your screen, and hold the paper in front of you.

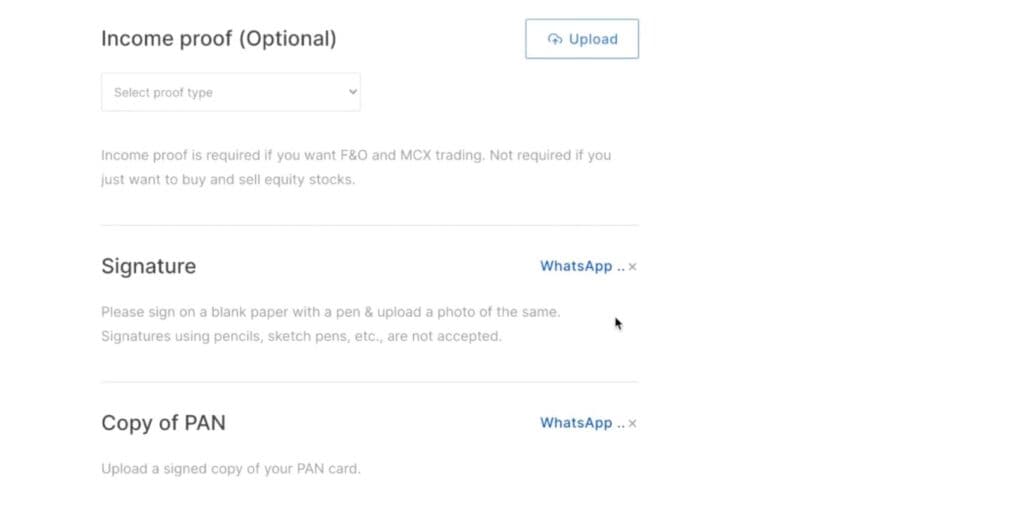

13. Upload your Documents

You need to upload your signature and PAN card to complete the Zerodha account opening process. Click a picture of these documents and upload them on the server.

Income proof is optional. However, you must have to upload income proof if you want to trade in the future and options (F&O) and MCX.

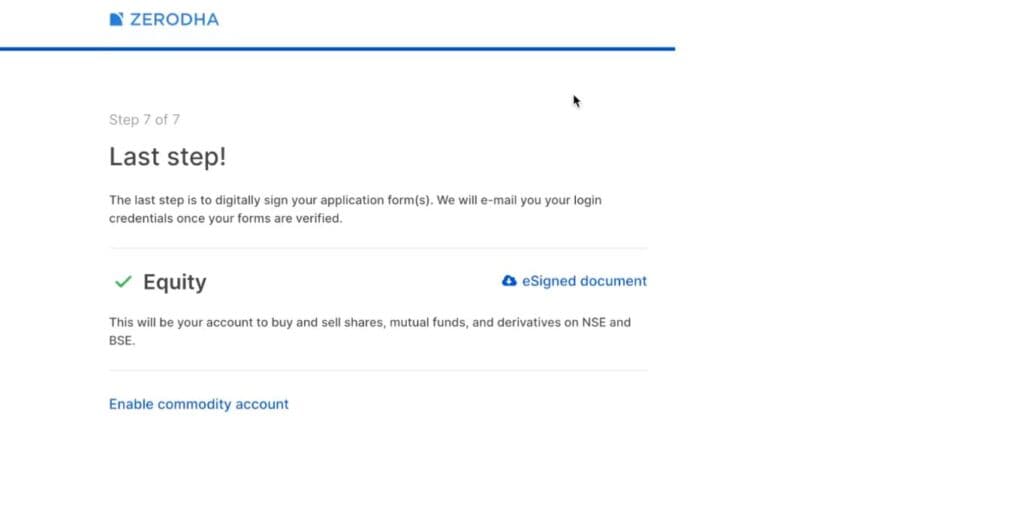

14. eSign your Documents

Now, you need to eSign all these uploaded documents with Digio.

15. Wait for the Login credentials

After eSigning all the documents with Digio, your account opening form will be submitted to Zerodha. Wait for 12 to 48 hours; you’ll receive login credentials at your email address.

You’ve successfully opened a Demat account with Zerodha. Now, you can invest and trade in the share market.

Conclusion

I hope you found this article helpful. Now, you can trade and invest in the share market. But this is just the first step of the share market journey. You have to learn many things to become successful in the stock market. So, bookmark Bullish Zone in your browser and visit regularly to learn about the share market.