What Is Unsettled Credit In Stock Market? – (A to Z Guide)

When I entered the stock market, I didn’t know about various common financial terms, and unsettled credit was one of them.

I’m sure you’re also a beginner if you don’t know what unsettled credit is in the stock market. That’s alright! I’m there for an explanation.

This guide will explain everything about unsettled credits/funds and the settlement hours for popular stock brokers.

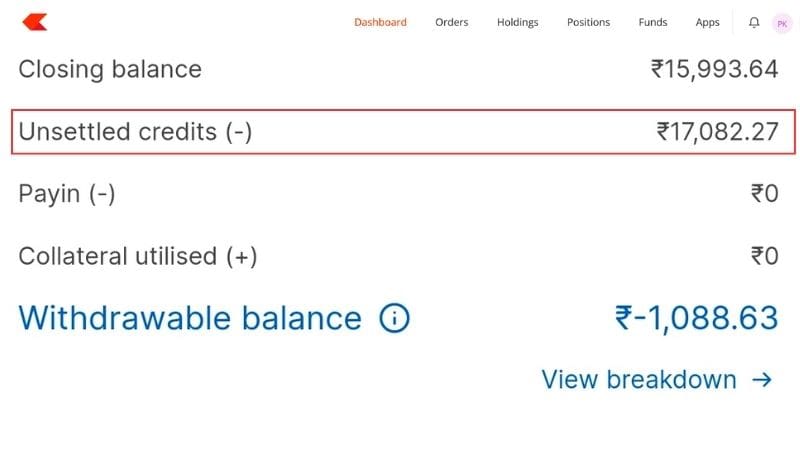

So, what is unsettled credit in the stock market? The unsettled credit/fund is the amount you’ve generated in intraday trades or by selling your holdings. This amount will be credited to your account after settlement hours. Generally, most stock brokers credit the profit to your trading account the next day.

What is the Settlement Period in the Stock Market?

If you’re new to the stock market, you must have heard the term “settlement period” several times. The settlement period is the duration in which a trade is executed and the transaction is fully completed.

Let me put it more clearly…

The stock market is the place of buyers and sellers. If you’ve some shares of Reliance in your Demat account and you want to sell them, on the other end, a buyer wants to purchase the Reliance share.

So, you’ll place the sell order on your broker platform, and the buyer will place a buy order on his broker platform. The order will go to the exchange (NSE or BSE) and be executed when the price matches.

Now, thousands of transactions occur on the exchange. So, it’s impossible to settle the transaction immediately. So, the stock exchange (NSE and BSE) settles all the transactions after market closing hours.

The time between order execution and completion of the transaction (until the buyer receives the share in his Demat account) is known as the settlement period in stock market language.

What is Quarterly Settlement in Zerodha?

The Securities and Exchange Board of India (SEBI) released a circular in July 2022, which instructed all recognized stock exchanges and brokers to transfer all funds back to the client’s bank account once a quarter.

Zerodha is also bound to this rule; they transfer all funds from your trading account to your bank account every quarter.

Zerodha’s quarterly settlement happens on the first Friday of the quarter, i.e., the first Friday of January 2023, April 2023, July 2023, and so on.

Zerodha Quarterly Settlement In 2023

Zerodha will transfer all funds to your bank account on the following dates-

| Quarterly Settlement | Date |

|---|---|

| First Quater | 6th January 2023 |

| Second Quater | 7th April 2023 |

| Third Quater | 7th July 2023 |

| Fourth Quater | 6th October 2023 |

When Will Zerodha Profit Be Credited?

Zerodha, follow the T+1 day settlement for equity and F&O orders, and the profit will be credited to your trading account the next trading day. Generally, Zerodha settles funds between 2:00 AM and 4:00 AM. You can use this profit for next-day trading.

Conclusion

I hope you understand the concept of the settlement period. Zerodha’s follow (T+1 day) settlement cycle for intraday profits. It means the profit will be credited the next trading day.