Support Bounce 50: A Profitable Strategy For Swing Trades

In my previous guide, I taught you about support and resistance. Today, I’m sharing a highly profitable swing trading strategy for beginners.

I have been constantly trading with this strategy, and it’s given a higher number of successful trades. The only drawback of this strategy is that you get fewer trades.

Still, it’s an excellent strategy for low-risk traders. If you want to become a profitable trader, you must strictly follow the important rules I have mentioned for this strategy.

But, before that, I want you to explain what swing trading is exactly because this strategy is applied only to swing trades.

What is Swing Trading?

Swing trading is a style of trading that captures short to medium-term gains in a stock. In this type of trading style, the traders buy a stock for more than one day and hold it for up to 3 to 5 weeks.

As soon as the price moves to a predicted target, the trader books the profit and waits for the next opportunity. Making 10% to 12% gains in the short term is easy in this type of trade.

In swing trading, we only focus on technical analysis. Because we are looking for short-term gain, so fundamental analysis doesn’t matter.

I’m sure you understand what swing trade is. It’s totally different from investing because in investing, we buy a share for the long term, like 5 to 15 years or even more.

Note

- Book the profit as soon as the target is reached.

- Search for stocks with uptrend or sideways.

- The timeframe for analysis should be 1 day.

- Don’t trade if there is some news about the stock or if there is a budget announcement and election results.

- Don’t enter into the trade if the stock formed a lower-low (LL) pattern below the support level.

Important Rule

- The stock price must touch or break the previous support during the pullback.

- The stock immediately forms a bullish or green candlestick after breaking the support.

- The stock should be part of NIFTY 50 or NIFTY Next 50.

- Don’t trade if the risk to reward is less than 1:2.

Support Bounce 50: Profitable Swing Trading Strategy

I’m hoping that you carefully read the rules. Because rules are the most important thing that you should not ignore.

Let’s start the strategy…

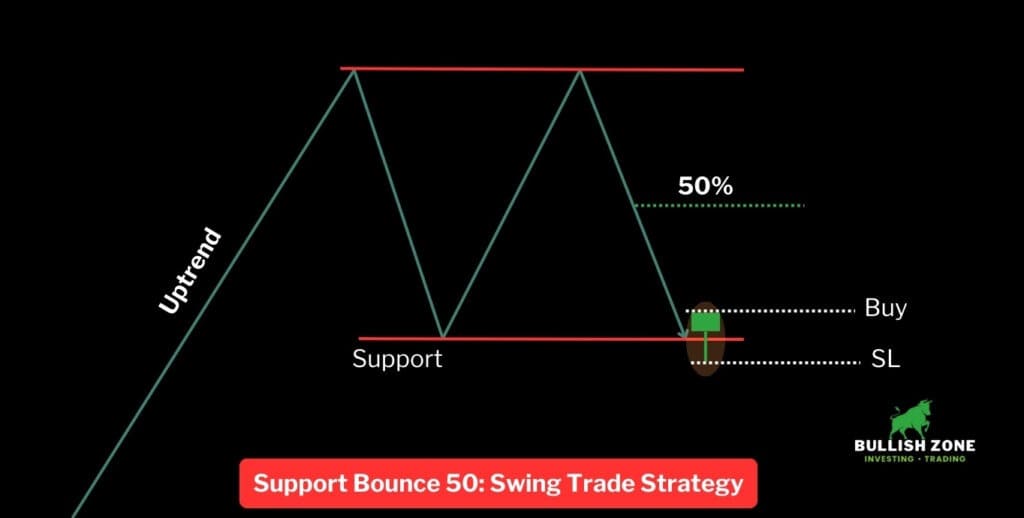

Step #1. Search for a stock that was previously in an upward trend.

Step #2. Find a previous support level where the stock price has bounced significantly.

Step #3. Draw a horizontal line on the lowest point of the support level.

Step #4. Let the price pull back to the support level.

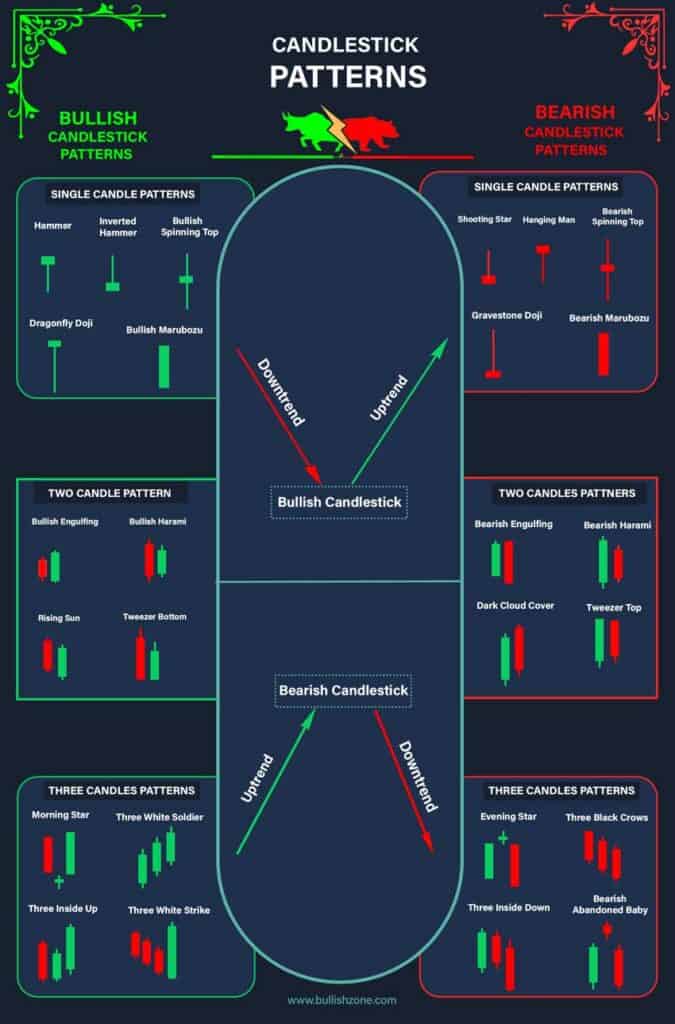

Step #5. Wait for a bullish candlestick (hammer, dragonfly doji, marubozu) or a strong green candle near the support zone.

Step #6. Mark the low of the pullback swing and the high of the bullish candlestick.

Step #7. Select the Fibonacci retracement tool, draw from top to bottom of this swing, and mark 50% of the Fibonacci retracement level.

Step #8. Buy above the high of the bullish candle with a stoploss of the lowest point of this swing.

Step #9. Book your profit when the price reaches 50% of the Fibonacci retracement level.

Note: We will not capture the trend reversal, so it’s necessary to sell the maximum quantity when the price recovers 50% of the previous downward swing.

Tip 1. As we already know, the target and stoploss, so before buying the stock, please confirm that the reward is 2 times or more than the risk involved.

Tip 2. Once the trade starts moving in your direction, trail your stoploss to the break-even level (entry price) and book partial profit once it’s reached 1.5 of the risk amount.

Some Example Charts of Support Bounce Strategy in NIFTY 50 Stocks

- Tata Steel Chart

- State Bank of India Chart

- SBI Life Insurance Chart

- Bajaj Finserv Chart

Conclusion

This is one of the easiest and most profitable swing trading strategies for NIFTY 50 stocks. I advise you to trade in NIFTY 50 and NIFTY Midcap 50 constituents because these stocks have significant volume. Don’t enter the trade if the risk involved exceeds the rewards.