How To Put Stop Loss in Zerodha? -(for Equity & Derivaties)

You are searching for how to put stop loss in Zerodha, which means you understand the importance of stop loss in trading.

Stoploss is a great feature that Zerodha (and many stock brokers) provides to avoid bigger losses when the share price goes against your prediction.

Nobody can stop you from becoming a successful trader if you learn and develop the habit of placing a stop loss for your every trade.

In this guide, you’ll learn how to place a stop loss in Zerodha to prevent bigger losses when shares go against your analysis.

Step-By-Step Process To Stoploss Order in Zerodha

Zerodha is India’s largest discount broker that allows placing a stop loss while buying any share.

You can decide the maximum loss you can bear in a trade and set the stop loss percentage while placing the buy order.

But, if you trade in derivates (F&O), then you cannot set your stop loss while placing the order. However, you can place a separate stop-loss order once your trade is executed.

I’ll also provide a step-by-step process to set stop loss in Zerodha for options trading. So, don’t skip reading any paragraphs because it’s about your trading capital.

Steps To Set Stoploss in Zerodha for Equity (Share) Trading

If you’re a beginner in the stock market, I’m pretty sure you trade on Kite App by Zerodha. So, I will teach you how to place a stop-loss order on the Zerodha Kite app.

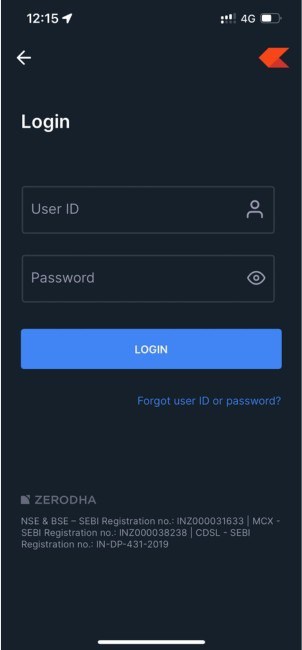

1. Open Kite by Zerodha App

Go to the apps menu and tap on the Kite app. Enter your Zerodha’s username, password, and 2-factor authentication code.

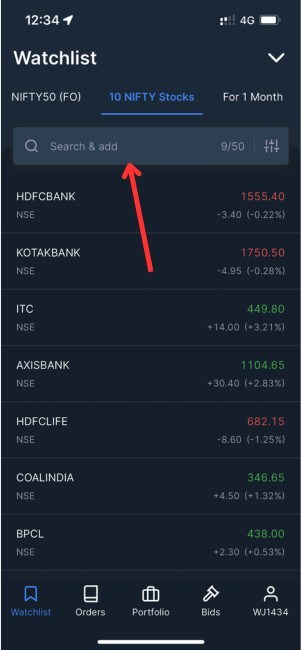

2. Add the Share in the Watchlist

Once you log in to the Kite platform, enter the share name/symbol you want to buy and add that share to the Watchlist.

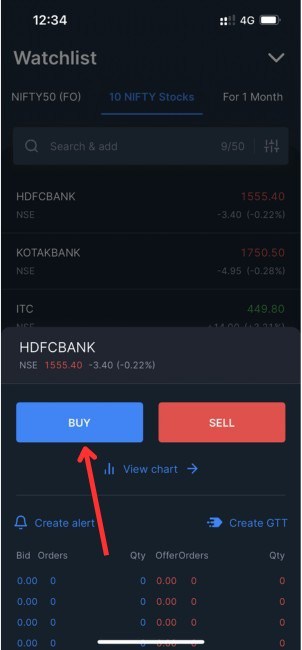

3. Tap on the Buy Button

Next, tap on the share name and the Buy button.

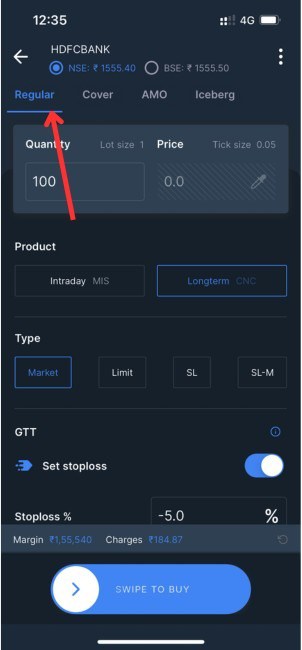

4. Select the Order Type Regular

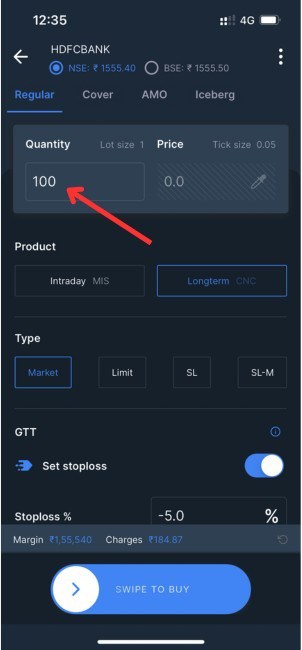

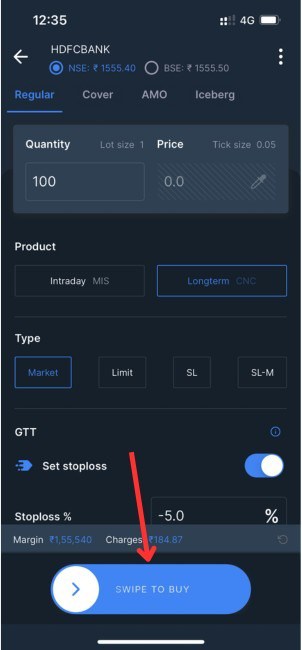

Here, you’ll see various order types, such as Regular, Cover, AMO, and Iceberg. Select Regular.

5. Enter the Quantity

Enter the number of shares you want to purchase in the quantity section. If you’re going to buy at a specific price, then enter that value in the price section. Your order will be executed when the share price hits your entered price.

But, if you want to purchase immediately, choose the Market order, and your order will be executed at the current price.

6. Select Order Type

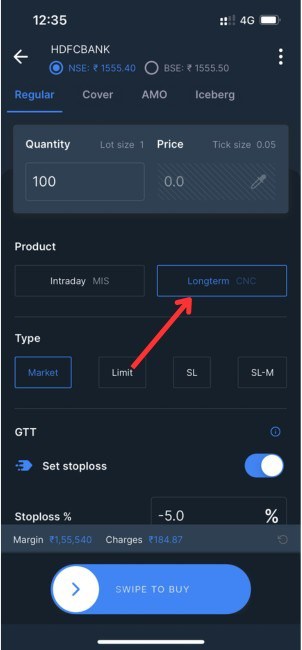

The next important step is to choose your order type. If you’re an intraday trader, then select MIS order.

Select CNC order type if you’re a swing trader planning to hold your position for over one day. I have written a detailed guide on CNC vs. MIS order types.

7. Toggle Set Stoploss Icon

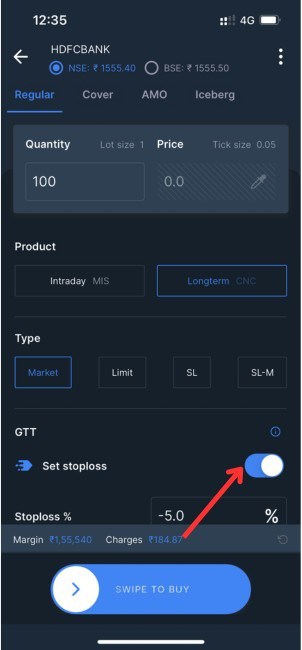

Head over to the GTT section and toggle the Set stoploss icon. If you want to set your target, you can enable that option too.

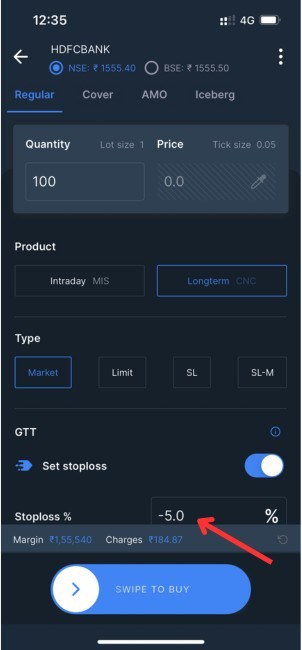

8. Enter Stoploss Percentage

Here, you have to enter your stoploss in percentage. So, decide your risk appetite (maximum loss you can bear in that trade) and enter the value in percentage.

9. Set Target Percentage

If you’ve enabled the target option, then enter the target percentage. The ideal stop-loss-to-target ratio is more than 1:2. But it depends upon market conditions.

10. Swipe the Buy Button

Once you’ve entered all the values correctly, it’s time to place the buy order. Just swipe the buy button to place the order on the stock exchange.

Steps To Set Stoploss in Zerodha for Options (Derivative) Trading

If you trade in the future and options, then Zerodha doesn’t provide an option to set stoploss and target while placing the order.

Instead, you have to place a separate stoploss order for options. Here’s how to set stoploss in Zerodha for options trading-

1. Open Kite by Zerodha App

Go to your smartphone apps drawer and open the Kite app. Enter your Zerodha username, password, and 2-factor authentication code to log in to the Kite platform.

2. Add Contract to Watchlist

Add the options contract (ITM or ATM preferred) to the Watchlist. Click here for detailed insights on ITM, ATM, and OTM in options trading.

3. Tap on the Buy Button

Tap on the option contract, then tap the Buy button.

4. Enter Buying Quantity

According to lot size, enter your buying quantity.

5. Select Order Type

If you’re an intraday trader (scalper), then select MIS order type. If you want to carry forward your position the next day, choose CNC.

6. Swipe the Buy Button

If you want your order to be executed instantly, then select Market price. Otherwise, choose Limit order and enter your buying price. Next, swipe the buy button to place the order.

7. Go to the Positions

Now, go to Portfolio> Positions window and tap the ongoing trade.

8. Tap on the Exit Button

Next, tap the Exit button to place a sell order at your decided stoploss price.

9. Change Order Type to SL

Once the sell window opens, change the order type to SL (stoploss).

10. Enter Stoploss Price

Enter your decided stoploss price.

11. Enter Trigger Price

Enter your trigger price (equal to or greater than the stoploss price).

12. Swipe Sell Button

Swipe the sell button to place the SL (stoploss) order. As soon as the options price hits the trigger price, your order will be sent to the exchange, and the sell order will be executed at your stoploss price.

Conclusion

You must develop a habit of closing your position when the share price starts trading below the stoploss. Every successful trader strictly follows their stoploss.

This good habit protects the trading capital in a volatile market. I hope you understand the importance of stoploss and how to place an SL order in Zerodha.