Scalping Vs. Swing Trading: Which Is Best For Beginners?

The ultimate goal of trading is to make a profit in the stock market, but every trader has a different strategy and trading style.

But, there has always been a hot debate between scalping vs. swing trading. Some people stand on the scalping side, while some are on the swing trading side.

If you’re a beginner and want to know which trading strategy is better for you, then read this guide with full attention.

I have spent over three years in stock market trading and have tested various strategies. I’ll tell you which strategy works better in stock market trading from my personal experience.

So, let’s start…

What is Scalping?

Scalping is a popular intraday trading form in which traders don’t carry forward positions. In the scapling, traders enter into trades and exit within a few minutes or hours.

So, scalpers take multiple small trades instead of holding the position for the entire trend.

The combined gains from multiple trades turn into a decent profit at the end of market hours.

Scalping is highly popular among derivative traders who trade in futures and options. A lot of traders are making decent profits with scalping.

Advantages of Scalping

- In scalping, the stoplosses are usually small.

- Scalping doesn’t require fundamental analysis.

- In scalping, the risk is less if a trade goes against the analysis.

- There is no risk of a market gap up or down because scalpers don’t carry forward positions.

- Scalping requires less market knowledge.

Disadvantages of Scalping

- High transaction costs are involved due to multiple orders.

- It requires high capital investment to make a decent profit.

- It impacts the trading psychology due to multiple stop losses hit.

Skills Required:

- Suitable for full-time traders.

- It requires quick decision-making ability.

- It requires risk and money management skills.

- Suitable for highly volatile stocks.

- Suitable for option buying.

What is Swing Trading?

Swing trading is another short-term trading strategy that is used to gain profit in the stock market.

In swing trading, the traders enter into a trade for a few days, weeks, or even months.

The swing trader exits their position once he achieves the desired target in the short term.

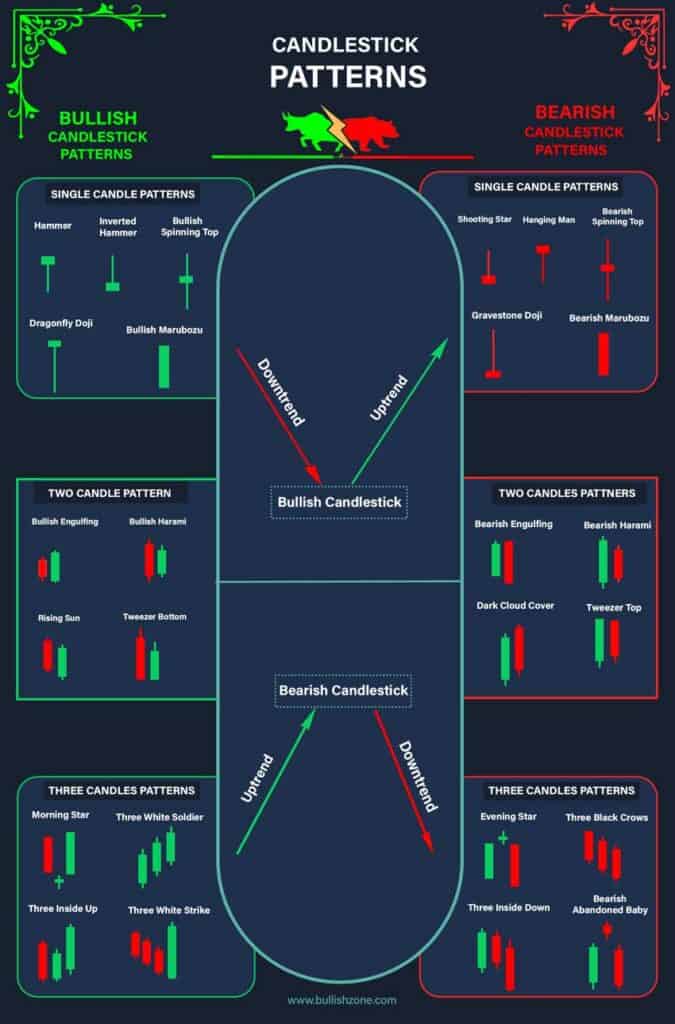

Generally, swing traders pick high-market capitalization stocks and trade positions based on technical indicators, price action, chart patterns, and candlesticks.

Skills Required:

- Decent knowledge of technical analysis.

- Suitable for part-time traders.

- Suitable for low volatile stocks.

- Suitable for equity and futures.

Scalping Vs. Swing Trading: Major Differences

Here are some major differences between scalping and swing trading:

| Metrics | Scalping | Swing Trading |

|---|---|---|

| Frequency of trades | High | Low |

| Holding period | Minutes and hours | Day and week |

| Timeframe | 1 minute, 5 minutes, 15 minutes | 30 minutes, 1 hour, daily |

| Risk involved | Low | High |

| Brokerage and transaction charges | High | Low |

| Profitability per trade | Low | High |

| Suitable for | Full-time trader | Part-time trader |

| Decision making time | Quick | Slow |

| Volatility | High | Moderate |

| Stress level | High | Low |

Scalping Vs. Swing Trade: Which One is Better For You?

It totally depends on the individual because the one that suits me might not suit you. However, scalping is suitable for those whose decision-making ability is very fast.

In scalping, you take multiple trades, exit on small profits, and stop losses. If you don’t cut your stop losses on time, all your capital will be wiped.

Also, you need to look at your computer screen all the time to judge the movements in the market.

Swing trading is for those who are not full-time traders. In this trading style, people buy a stock for a few days or weeks, exit on a decided target, or stop losses.

If you’re a part-time trader involved in a job or other business, swing trading is the right trading style for you.

Conclusion

It’s difficult to choose between scalping and swing trading without knowing yourself. Scalping demands high devotion and decision-making ability to enter and exit a trade quickly.

A wrong trade will ruin all your earned profit and wipe out the capital if you don’t exit on a decided stop loss. So, ask yourself and decide what kind of trading style suits you.