What is CE and PE in Stock Market? -(Beginner’s Guide)

If you’re searching for what is CE and PE in the stock market, it means you’re a beginner to the stock market.

Moreover, sometimes, people with financial backgrounds are unaware of such terms.

My responsibility is to educate you on standard terms used in the stock market and their significance in achieving your financial freedom.

In today’s guide, we shall discuss CE and PE in the stock market. So, being a responsible learner, don’t skip any paragraphs.

What is CE and PE in Stock Market?

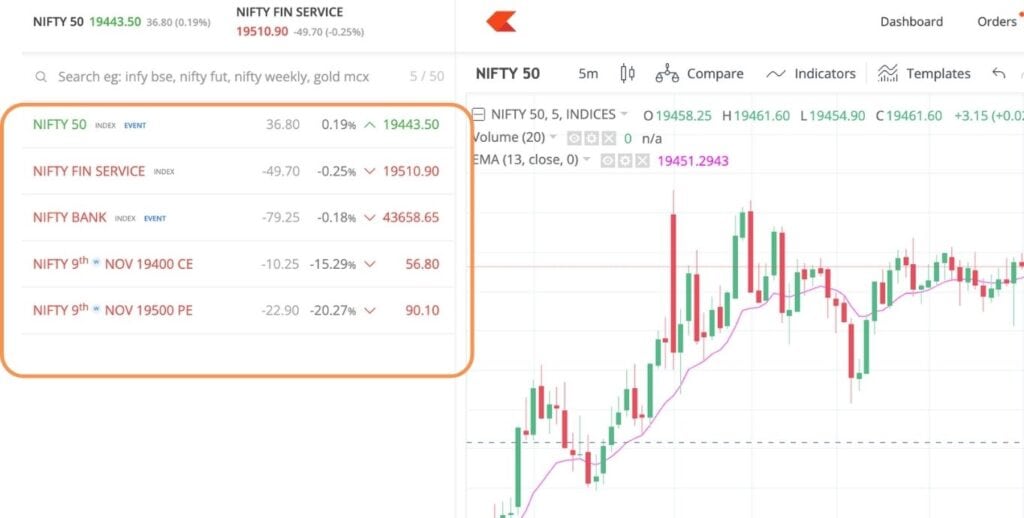

CE and PE are the two most popular terms used in option trading. The CE abbreviation is for Call European, and the PE abbreviation is for Put European.

In day-to-day language, traders often refer to CE as a Call Option and PE as a Put Option. I’m sure you must have heard these two terms.

These are the standard definitions, but I’ll explain CE and PE in simple and easy language!

First, start with the concept of option trading…

Suppose you want to buy a plot somewhere; its current price is 20 lakh. You have news that the government is planning a metro station near that location, and after 6 months, the plot price will hike to 1 crore.

So, instead of paying the whole price of the plot, i.e., 20 lakh right now, you’ll make a timebound contract with the seller and pay a token amount (let’s say 10,000).

If the metro station comes to that location, the price will hike to 1 crore, and you’ll make a huge profit. But the seller will keep that token amount (i.e., 10,000) if the metro station doesn’t come.

This is how option trading works. So, instead of paying the actual price of financial instruments (stock, index, or commodity), people buy and sell the contracts.

Practical Meaning of CE and PE in the Share Market

From a buyer’s perspective, CE is for those who think the price of a stock or index will go up, and PE is for those who think the price will go down.

From a seller’s perspective, CE is for those who think the price will not go above a particular value, and PE is for those who think the price will not go below a particular value.

Let’s understand with an example…

Suppose the current price of Reliance shares is 2500, and if a buyer thinks that its price will go up this month.

If he/she buys a monthly contract of call option (CE) of 2600 by paying a token amount determined by the stock exchange.

If the price reaches 2700 in a given period of time, then the buyer will make money.

But, if Reliance’s share price does not go above 2600, then the contract price will go zero, and the seller will make money.

How Does the Price of CE and PE is Determined?

The price of CE and PE is decided by its intrinsic and time values. The intrinsic value is the price difference between the current price of the stock and the chosen strike price. The difference between premium price and intrinsic value is the time value.

- Premium Price= Intrinsic Value + Time Value

- Intrinsic Value= Strike Price – Current Stock Price

- Time Value= Premium Price -Intrinsic Value

Conclusion

I hope you understood about CE (Call Option) and PE (Put Option). In the next article, I’ll explain ITM, ATM, and OTM strike prices and also tell you which strike price is good for option buyers. If you’ve any questions or doubts on this topic, feel free to ask via the Contact Us page or in the comment box.

Similar Guides: