What is ITM, ATM, and OTM in Options Trading? – (Detailed Guide)

If you’re a newbie to the stock market, you must be confused between ITM, ATM, and OTM. These terms are immensely popular in options trading.

In today’s guide, we’ll discuss ITM, ATM, and OTM in detail.

I’ll keep this guide in straightforward and easy-to-understand language so that a person with a non-financial background can also understand.

I can assure you that you don’t need to read further to understand option moneyness. Ultimately, I’ll also tell you which is better for buying and selling options.

I recommend you memorize the full form of these terms because you must try to learn stock market trading.

- ITM= In The Money

- ATM= At The Money

- OTM= Out of The Money

What is ITM in Options Trading?

I’m hoping that you will read my previous guide on what CE and PE are in the stock market.

If you buy the Call option (CE) and the stock price goes up, then you make a profit. But, if the stock price starts falling, then the Put option (PE) will give you a profit.

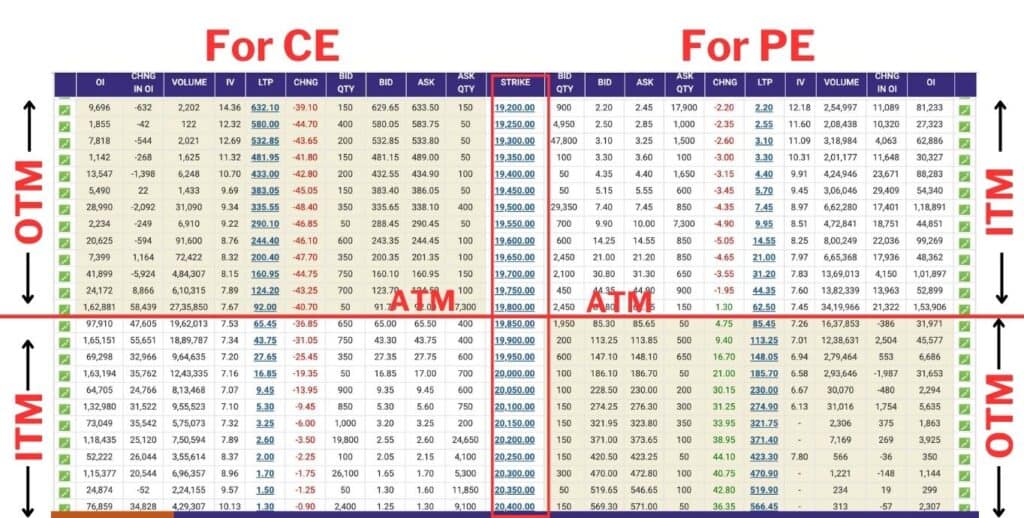

Let’s suppose NIFTY 50 is trading at 19800, then for the Call option (CE), all the strike prices below 19,800, like 19,750, 19,700, 19,650, 19,600, etc. are In the money (ITM).

Similarly, for Put options (PE), all the strike prices above 19,800, like 19,850, 19,900, 19,950, 20,000, etc., are In the money (ITM).

So, from above, we can conclude that- In the money (ITM) option is one with a strike price that has already been surpassed by the current stock price.

Suppose the current price of a stock is 2500; then ITM strike prices will be the following:

| For CE (Call Option) | For PE (Put Option) |

|---|---|

| 2400 | 2600 |

| 2300 | 2700 |

| 2200 | 2800 |

| 2100 | 2900 |

| 2000 | 3000 |

What is ATM in Options Trading?

ATM stands for At the money option. It means the strike price near which the market is trading is known as At The Money option (ATM).

For example, if NIFTY 50 is trading at 19,810, then the 19,800 strike price will be At the money (ATM) for both Call and Put options.

What is OTM in the Stock Market?

If the price of a stock or any underlying asset is 2000, then all strike prices above 2000 will be OTM for Call options, while strike prices below 2000 will be OTM for Put options.

In other words, the OTM option is the one that has a strike price that the underlying security has yet to reach, meaning the option has no intrinsic value.

The value of OTM will become zero when the price of that stock or underlying asset will not reach that value before expiry.

Which Strike Price is Best For Option Buying?

In the money (ITM) options have the highest intrinsic value, and they go under the lowest time value decay when the market goes sideways.

So, it’s always better to select the In The Money (ITM) strike price while buying Call or Put options.

I prefer a 2-3 strike price deep in the money option while buying near the expiry date and At the money (ATM) or a slight out of the money (OTM) option when the expiry is far.

For example, if NIFTY 50 trades at 19,500, then my strike price selection for call options (CE) will be:

- Friday= 19,550 (OTM)

- Monday= 19,500 (ATM)

- Tuesday= 19,450 (ITM)

- Wednesday= 19,400 (ITM)

- Thursday (on weekly expiry day) = 19,350 (ITM)

Conclusion

As an experienced trader, I won’t advise you to trade in OTM because that option doesn’t have any intrinsic value, and time decay will make you losses.

I hope you understand what is ITM, ATM, and OTM in the stock market. You can ask anytime if you have doubts about these terms.