How To Select Stocks For Intraday (6 Golden Rules)

Are you struggling to find the right stock for intraday trading? It’s a common issue that every beginner trader faces.

Intraday trading is a great way to generate regular income from the stock market. It differs from long-term investing and requires an intelligent approach because all positions are square-off the same day.

I’ll share a few secret stock selection methods for intraday trading in this guide. If you’re a beginner, this guide will help you pick the right stock for intraday.

6 Golden Rules For Selecting a Stock for Intraday

To become a successful intraday trader, you must be disciplined and follow specific rules. It’s more important than the knowledge of technical analysis.

Here are six golden rules you must keep in mind while choosing a stock for intraday trading:

1. Choose Liquid Stocks

The first rule of selecting a stock for intraday trading is checking its liquidity. High liquidity means more interested buyers and traders in the stock.

As we buy and sell stock on the same day, we must ensure a high volume of shares are bought and sold.

High liquidity allows you to enter and exit your position without any slippage in the stock price.

The stocks listed in the Nifty 50 and Nifty Next 50 index generally have high liquidity. I select the stocks that have more than 1,00,000 active buyers and sellers.

2. Choose Volatile Stocks

The next thing to consider while selecting an intraday stock is its volatility. All intraday positions will be automatically squared off at 3:20 PM.

So, the stock must have decent volatility so that we can buy at a lower price and sell at a higher price.

However, extreme volatility could be counterproductive and frequently trigger the stoploss.

For example, Adani Group shares are highly volatile, and I usually avoid these stocks for intraday trading.

3. Follow Market Trends

Always remember this: “Trend is your friend until it bends.” It would be best to plan your trades in favor of market trends to catch more prominent movements.

If a stock is in an uptrend, look for a buying opportunity near the support zone, and if the share is in a downtrend, search for a selling opportunity near the resistance zone.

Beginner stock market traders often mistakenly trade in ways that are opposite to the market trend.

4. Follow Sector Trends

A secret rule of intraday stock selection is checking the sector trend. Sectoral performance affects shareholder sentiments, and prices move in that direction.

Suppose you have bought an IT stock, but the whole IT sector is falling continuously. Will you hold that stock?

No..! You’ll sell that stock in fear. That’s why checking sectoral trends is essential while selecting an intraday stock.

5. Find Breakout Stocks

If a share price breaks out after several hours or days of consolidation, the price generally continues moving in that direction.

The momentum of breakout stocks is high, giving more significant profit in intraday. So, check for a stock that has recently given any breakouts.

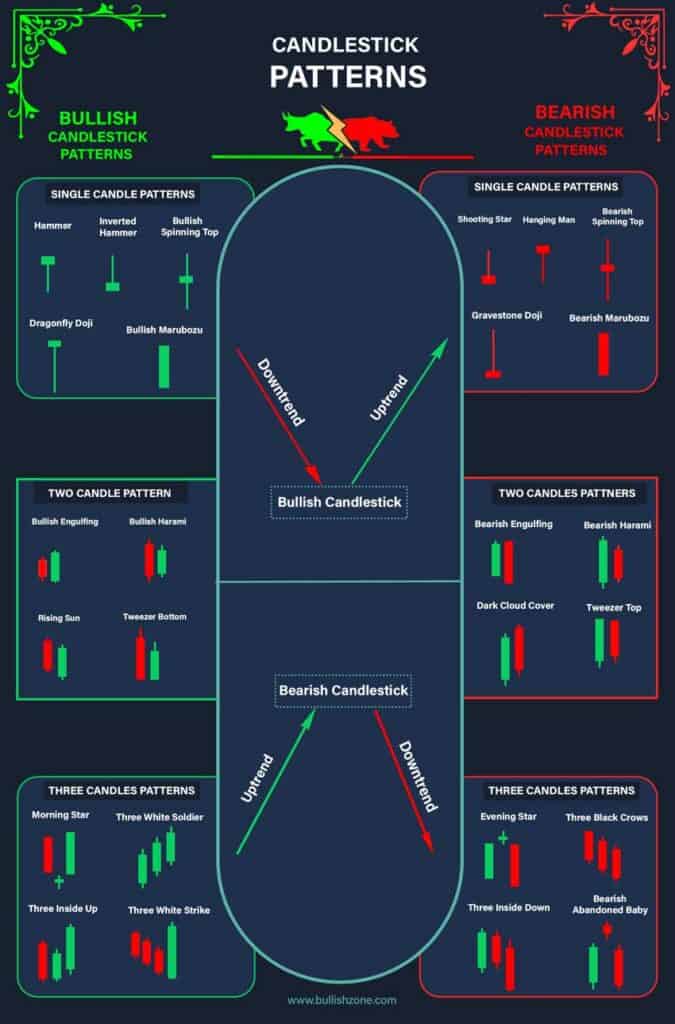

Every night, I check the candlestick chart of the Nifty 50, Midcap, and Smallcap stocks and add the breakout stocks to my intraday watchlist.

6. Check News

It would be best to filter the news-sensitive stocks because they are highly volatile and can give you good profit in intraday.

You must have seen the result of the Hindenburg report on the Adani Group. The company’s share price dropped by 60% in just three days.

I recommend you find the stocks that qualify for the above five rules and check their News.

After that, check for the earning report release date or any specific news about that stock and pay extra attention to the live market.

Conclusion

I hope you understand how to select stocks for intraday to make profits. Above that, you must define your daily risk capacity and manage the position size accordingly. I hope you enjoyed reading this article. Share your valuable appreciation in the comment box.