Heikin-Ashi Vs. Regular Candlestick: Which One Is Better? – (Answered)

You’re searching for the difference between Heikin-Ashi Vs. Candlestick means you’ve spent decent time in the stock market.

TradingView shows standard Japanese candlesticks by default; however, there is an option to switch to the Heikin-Ashi candlestick.

But it’s essential to know the difference between the Japanese candlestick and the Heikin-Ashi candlestick before switching.

In this guide, I’ll explain the significant differences between both candlesticks in simple language.

After this article, I’ll share an options trading strategy based on the Heikin-Ashi candlestick. So, don’t miss out on that strategy.

What Is Heikin-Ashi Formula?

The regular candlestick is formed on open-high-low-close (OHLC). In contrast, the Heikin-Ashi candlestick formation is based on the Heikin-Ashi formula that considers the value of the previous candlestick.

So, we need to understand what the Heikin-Ashi formula is.

- Open= Average of open and close price of the previous candlestick

- Close= Average of open, high, low, and close price of the current candlestick

- High= Highest value of the current candlestick

- Low= Lowest value of the current candlestick

In the Heikin-Ashi candlestick, the High and Low are similar to the regular candlestick. Still, the Open price considers the value of the open and close price from the previous candlestick.

Let’s understand the Heikin-Ashi formula in analytical terms:

- Open= 1/2(Open + Close of previous candlestick)

- Close= 1/4(Open + High + Low + Close price of current candlestick)

Difference Between Heikin-Ashi And Normal Candlestick?

From the above Heikin-Ashi formula, you can easily understand that the opening value of the current Heikin-Ashi candlestick is dependent on the opening and closing price of the previous candlestick.

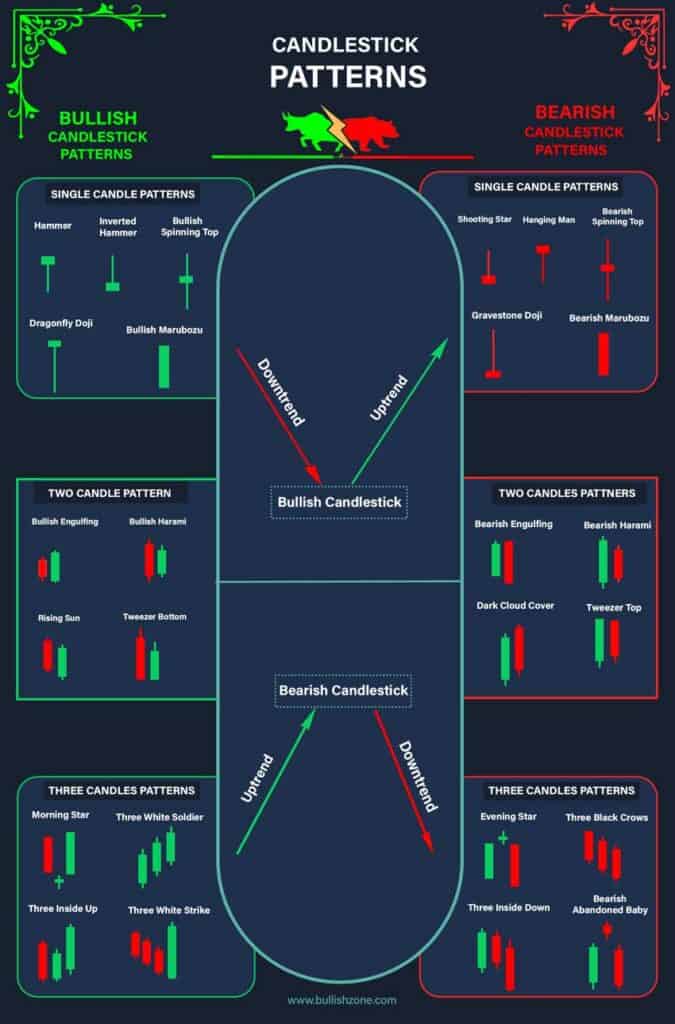

A lot of traders couldn’t differentiate between Heikin-Ashi and standard Japanese candlestick.

So here’s the difference between both candlesticks:

| Regular Candlestick | Heikin-Ashi Candlestick |

|---|---|

| A regular candlestick doesn’t clearly show the trend of a chart. | The opening and closing value of a Heikin-Ashi candlestick is dependent on the opening and closing value of the previous candlestick. |

| A standard candlestick chart doesn’t look smooth in gap-up and gap-down openings. | Heikin-Ashi candlestick clearly shows the trend of a chart. |

| A regular candlestick only focuses on today’s price movement. | The Heikin-Ashi candlestick chart looks smooth in gap-up and gap-down openings. |

| A normal candlestick only focuses on today’s price movement. | Heikin-Ashi candlestick also focuses on the previous price movement. |

Is Heikin-Ashi Reliable?

Heikin-Ashi considers the average price. from its previous candlestick; it indicates the overall trend on a chart. This is more reliable than regular candlestick in terms of predicting the trend of an instrument.

Is Heikin-Ashi Better Than Normal Candlestick?

It depends upon personal preference. It’s easy to identify the trend with the Heikin-Ashi candlestick because it considers the average opening and closing price of its previous candlestick.

Generally, the Heikin-Ashi candlestick is popular for swing trading, while intraday traders use regular candlestick.

Do Professional Traders Use Heikin-Ashi?

Yes, many professional traders use the Heikin-Ashi candlestick to identify the trend of a stock or its derivatives because it helps smooth out price data. Again, it’s personal preference because some traders use exponential moving averages (EMA) to identify trends in the long term.

Conclusion

The Heikin-Ashi candlestick helps identify the trend on a chart quickly. The formation of green Hekin-Ashi candlesticks indicates an uptrend, while red candlesticks indicate a downtrend on a graph.

In the next article, I’ll post a profitable options buying strategy based on the Heikin-Ashi candlestick. So, please keep visiting our homepage for helpful stock market-related guides.