Heikin-Ashi EMA Strategy: Best For Option Trading

In my Heikin-Ashi candlestick comparison guide, I promised a profitable options trading strategy based on the Heikin-Ashi candlestick.

Today, I’m here with the Heikin-Ashi EMA strategy that gives a high risk-to-reward ratio.

I have been regularly trading in Nifty and Bank Nifty options. It always gives a higher risk-to-reward, and you can make a big profit with intraday option buying.

But, this strategy is only profitable if your position sizing is accurate and your psychology is strong. Also, you must strictly follow the rules and tightly trail your stoploss.

Are you ready for this powerful option-buying strategy? Read this guide carefully, and don’t skip any paragraphs.

I’ll divide this guide into different subheadings like important information, strategy rules, entry and stoploss, trailing stoploss, and profit booking.

Heikin-Ashi EMA Strategy For Option Buying

So, let’s start with some important information first…

| Candlestick Type | Heikin-Ashi |

| Timeframe | 3 Minute |

| Indicator | EMA Crossover |

| EMA Lenght | 5 & 9 |

| Preferable | Nifty & Bank Nifty |

| Timing | Opening Hours (9:15 AM to 10:30 AM) |

From the above information, it’s clear that we’ll apply this strategy on the Heikin-Ashi candlestick chart with a 3-minute timeframe.

Important Rules:

- You’ll only enter make entry if it meets the conditions mentioned in the strategy rules.

- Your position sizing must be accurate; otherwise, it will impact your psychology, and you’ll make a huge loss even if the market goes in your direction.

- You’ll trade with only 1 to 2 lots for at least a week to gain confidence in this strategy.

- You’ll partially book profit if you get over 10% return and trail the stoploss for the remaining quantity to entry price.

- You’ll trade your maximum quantity in the direction of market trends.

So, you must remember these five important rules to make a huge profit from this strategy.

Indicator

In this strategy, we’ll use two Exponential Moving Averages (EMA). The first EMA has a length of 5, and the second EMA has a length of 9 candles.

Click on the indicator option in TradingView and search for EMA. Click on the Exponential Moving Average twice to apply this indicator.

Ensure you’ve applied it on the Heikin-Ashi candlestick chart, not the regular Japanese one.

Strategy Rules:

These are the essential strategy rules for entering a trade. First, we’ll look at the sell-side because selling always happens fast, giving a huge opportunity to make a good profit in put option buying.

First confirmation: If you get an EMA crossover in the first few minutes of market opening, then it’s a first confirmation, and you should be alert for a second confirmation.

Second confirmation: The second confirmation is to ensure that the red candle has Open=High (no upper shadow)

Note– If I say red candle, it means our plan is for the selling side (PE buying). If you’re a beginner, read my other CE and PE guide.

Entry: As soon as you get both confirmations, make a position in a deep-in-the-money (ITM) PE contract.

I recommend you trade in deep-in-the-money-strike prices because it has negligible time decay. If you don’t know what ITM, ATM, and OTM are in the stock market, then read this guide.

First confirmation: If you don’t get an EMA crossover, then wait for a red candle that crosses the 9 EMA line with Open=High (no upper shadow).

Second confirmation: Mark the low of the alert candle, wait for the next four candles to break, and give a closing below the low of the alert candle.

If the next four candles don’t give a closing below the low of the alert candle, then we’ll ignore this trade.

Entry: If it gives a closing below the low, then we’ll buy a deep-in-the-money (ITM) put option and mark the high as a stoploss of the alert candle.

Trailing Stoploss & Target:

This strategy gives higher risk-to-reward if the market is in a downtrend. So, we’ll trail our stoplosses to capture bigger moves.

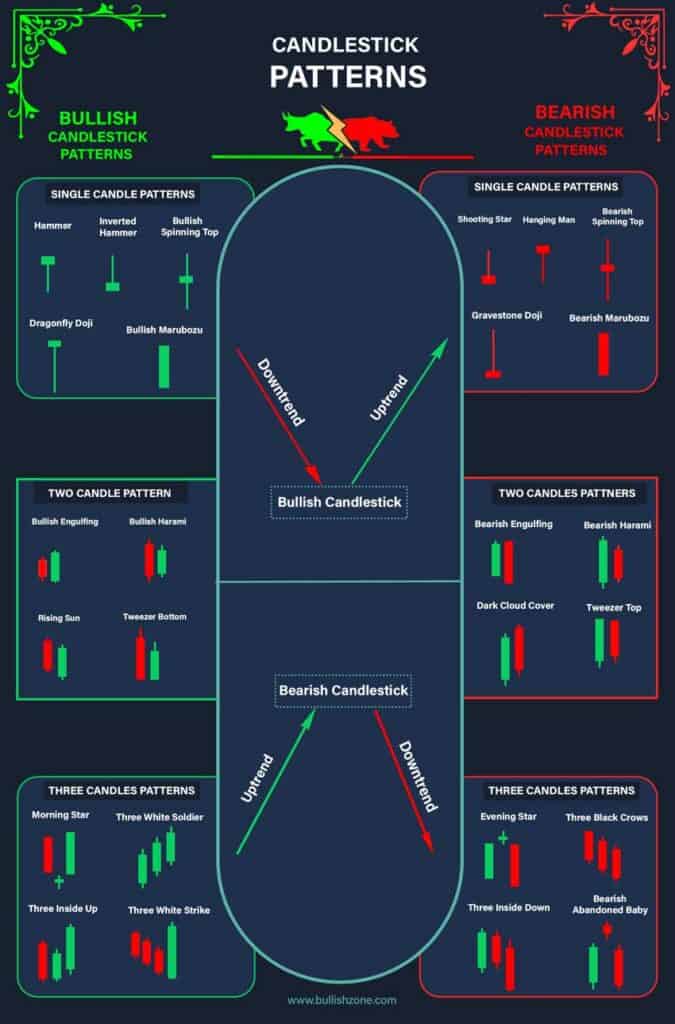

Once the market goes in your direction, first trail your stoploss near the entry price, then wait for a Doji candlestick formation.

Mark the high of the Doji candlestick and exit all positions if any candle closes above the high of Doji.

This strategy has no fixed target, so partially book profit if you get over 10 to 15% return. Exit all positions if you get the next crossover of 5 and 9 EMA.

How do we prevent time decay in a sideways market?

The biggest disadvantage of options buying is the premium decay in the sideways market. But, with this strategy, you can avoid time decay in the sideways market.

After the first trade, mark the day low, and we’ll plan our next trade in the selling direction below the day low.

Conclusion

I’m repeating it again: rules and position sizing are the key factors to extract maximum profit from any trading strategy. Follow the above rules and trade with smaller quantities for a couple of weeks to gain confidence. After that, you can slowly increase your quantity size.