AmiBroker Vs. TradingView: Which One is Better? (In-depth Comparison)

A country cannot win a war with outdated missiles and fighter jets. To win a battle, you must be equipped with advanced weapons.

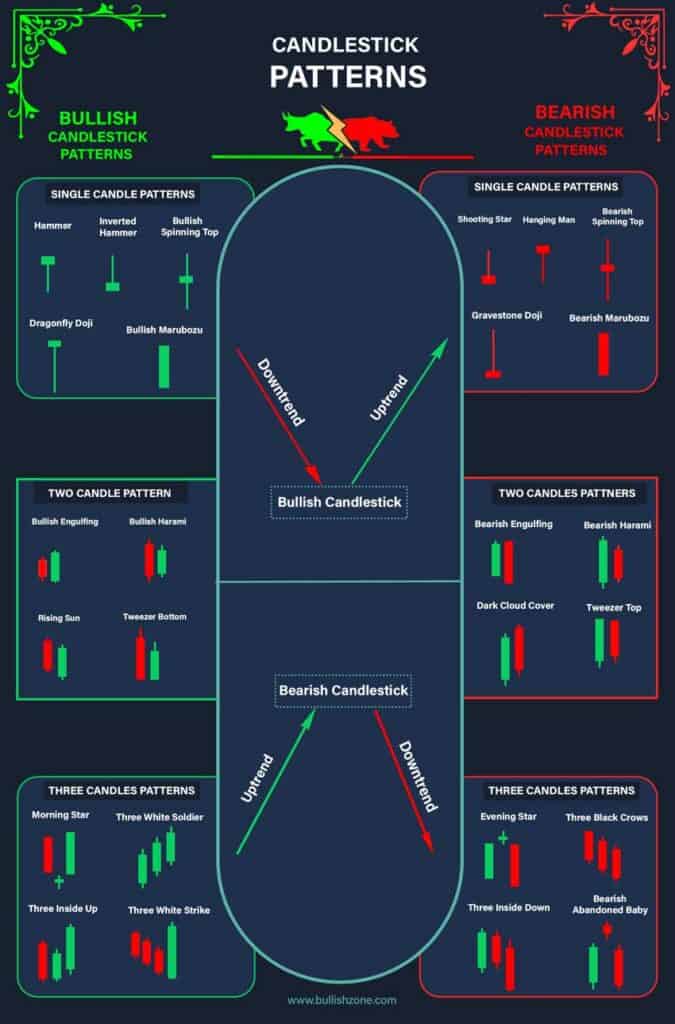

Trading in the stock market is also like a tug-of-war fight between bulls (buyers) and bears (sellers); whoever wins the battle, the stock price moves in that direction.

Similarly, a charting tool is essential to win the trading battle. It allows you to visualize and analyze the stock price movement in real time.

TradingView and AmiBroker are the two most popular charting tools used worldwide. Both tools are overloaded with valuable features and data, which are essential for trading.

In this guide, I’ll compare AmiBroker vs. TradingView, and after reading the comparison, you’ll be able to decide which one is better according to your requirements.

Differences Between AmiBroker vs. TradingView

Let’s start with differences first…

| Feature | AmiBroker | TradingView |

|---|---|---|

| Deployment | On-Premises | Cloud & On-Premises |

| Markets | Equity, Options, and Futures | Equity, FOREX, Commodity, and Cryptocurrency |

| Performance | Very fast | Comparatively slow |

| Indicators | Customizable indicators and drawing tools | Lots of pre-built indicators and drawing tools |

| Backtesting | Advanced backtesting with customized strategies | Not effective in backtesting |

| Programming | AmiBroker Formula Language (AFL) | Pine Script |

| Price | Standard Edition: $299 (one-time) Professional: $369 (one-time) Ultimate Pack Pro: $499 (one-time) | Lifetime Free: (limited features) Essential: $12.95/mo Plus: $24.95/mo Premium: $49.95/mo Expert: $199.95/mo Elite: $349.95/mo Ultimate: $499.95/mo |

| Trial | 30-days free trial | 30-days free trial |

These are the fundamental differences between AmiBroker and TradingView. Next, we’ll look at various features needed for trading in the stock market.

So, continue reading this article…

Features Comparison of AmiBroker Vs. TradingView

It’s time to compare the finest charting tools for Indian traders. I already told you the fundamental differences between AmiBroker and TradingView in the above table.

Here, we’ll look at the various features of these charting tools…

1. Installation

AmiBroker is a desktop-based application, while TradingView is a cloud-based tool. So, you can directly access TradingView by opening tradingview.com in your browser.

To access AmiBroker, you must first download the setup file from the official website and install it on your computer.

Because TradingView is a web-based charting tool, you can access it on any platform, such as Windows, macOS, Android, iOS, etc.

But AmiBroker is available for Windows only. So, cross-platform accessibility is not possible with this.

Verdict: TradingView doesn’t require any installation, and it can be accessed on any device browser. So, TradingView is a clear winner.

2. Data

Data is another crucial factor to consider while choosing charting tools for trading. TradingView provides an in-built data feed, while AmiBroker doesn’t.

In the case of AmiBroker, data needs to be bought separately from data vendors. Many data feed providers in India provide real-time data from stock exchanges.

Again, it’s essential to understand that AmiBroker requires additional effort and skills to integrate the data feed.

Verdict: TradingView comes with in-built data, but in the case of AmiBroker, data needs to be bought separately. So, TradingView clearly wins the battle.

3. Application Language

Application language is another crucial aspect you should consider before purchasing these tools’ premium plans.

As far as AmiBroker is concerned, it uses AmiBroker Formula Language (AFL), and TradingView uses Pine Script.

I have used both of these tools for an extended period, and I can say that both languages are pretty similar.

Initially, you’ll definitely face some difficulties in creating strategies for backtesting, but the internet is full of information.

Programming in AFL and Pine Script has become much easier in the era of the artificial intelligence world.

Just provide the correct prompt to ChatGPT, and it’ll create a readymade code for AFL and Pine Script for strategy backtesting.

Verdict: In terms of programming language, both of these tools are equally intuitive. So, I would give a tie between these charting tools.

4. Performance

AmiBroker is a desktop-based application, while TradingView is deployed on cloud servers.

So, as far as performance is concerned, AmiBroker is very fast and responsive, while TradingVew is comparatively slow.

I have been using both of these charting tools for over a year, and I can clearly say that AmiBroker is blazing fast and instantly loads the data, while TradingView takes some time to show the data.

Verdict: In terms of performance and loading speed, AmiBroker clearly wins the battle by a huge margin.

5. Markets

AmiBroker is specifically designed for trading in stocks and their derivatives. However, you can configure data feed plugins to retrieve real-time data of forex charts.

TradingView provides more options like equity, forex, commodities, and cryptocurrencies. The best part is everything is pre-built, and you don’t need to configure anything extra.

Verdict: In terms of market data, TradingView is more versatile than AmiBroker. So, TradingView is a clear winner of this battle.

6. Layouts

For intraday trading, you need to look at multiple charts. If you trade in Bank Nifty options, tracking the movement of HDFC Bank, ICICI Bank, and Axis Bank is essential.

Option prices move accordingly because these banks have a higher weightage in the NIFTYBANK index.

TradingView has many readymade layouts, making it easy to analyze a stock in multiple timeframes.

If you have a more extensive screen setup, you’ll split it into 16 parts and track multiple scripts at different timeframes.

AmiBroker also provides multiple Windows support, but you must create and customize the Windows layout according to your needs.

Verdict: Both charting tools support multi-layout functions. So, I would give them at tie here.

7. Backtesting

I won’t argue if someone says AmiBroker is the king of all tools in backtesting and analyzing past data.

I have used many charting tools, but AmiBroker is the best in strategy backtesting and analyzing historical data.

Before implementing it into the live market, you can customize your strategy and back-test it from historical data.

TradingView also provides a backtesting feature, but that’s not as effective as AmiBroker.

Verdict: AmiBroker is a clear winner in terms of backtesting on historical data.

8. Algo-trading

In today’s world, many professional traders automate their trading work with their own strategies.

So, algo-trading is another aspect to consider while investing in a charting tool. Algo trading is easy with AmiBroker because you can easily connect with popular brokers like Zerodha, Upstox, Alice Blue, Sharekhan, etc.

As far as algo trading with TradingView is concerned, there is no direct way to integrate your trading work. You can use third-party APIs like Algomojo to automate the algo-trading.

Verdict: AmiBroker is used by many professional traders for algo-trading.

9. Cost

TradingView has a monthly subscription plan, while AmiBroker needs a single-time license. However, you need to buy data feeds that come with a separate monthly subscription.

But, you will have the freedom to choose the data feed supplier according to your requirements.

If we talk about the pricing of AmiBroker data feed services, then it comes to approximately ₹500/month for the Indian stock exchange.

The monthly cost of TradingView is also similar. Its Essential plan comes at ₹995/month, but that’s insufficient for an experienced trader.

The premium plan of TradingView costs approximately ₹ 3,995/month, which provides 20,000 historical bars and eight chart layouts per screen.

Verdict: The cost of TradingView and AmiBroker is nearly similar. But, the AmiBroker monthly cost depends on third-party data feed providers.

Helpful Guide: How to access TradingView Premium for Free

10. Customer Support

AmiBroker offers comprehensive support services, including a user forum, extensive documentation, email support, and access to a knowledge base.

Email support ensures direct assistance from the AmiBroker team. Their documentation is detailed and regularly updated, aiding users in navigating the platform effectively.

TradingView also provides robust support, offering a community forum, a vast library of educational content, and an emailable responsive customer support team.

Verdict: Both of them are great at customer support, but TradingView’s response time is a little faster compared to AmiBroker.

Conclusion

AmiBroker is an advanced tool for backtesting and analyzing historical data, while TradingView offers cross-platform accessibility. Still, professional traders mostly use AmiBroker to backtest strategies and automate their trading work.

If you’re a beginner in the stock market, I advise you to go with TradingView, but if you are already making money, I recommend you to test out AmiBroker for several weeks.